The United States Electoral College is a body of electors established by the United States Constitution, constituted every four years for the sole purpose of electing the president and vice president of the United States. The Electoral College consists of 538 electors, and an absolute majority of 270 electoral votes is required to win an election. Pursuant to Article II, Section 1, Clause 2, the legislature of each state determines the manner by which its electors are chosen. Each state’s number of electors is equal to the combined total of the state’s membership in the Senate and House of Representatives; currently there are 100 senators and 435 representatives.[1][2][3] Additionally, the Twenty-third Amendment provides that the District of Columbia (D.C.) is entitled to a number of electors no greater than that of the least populous state (i.e. 3).[4]

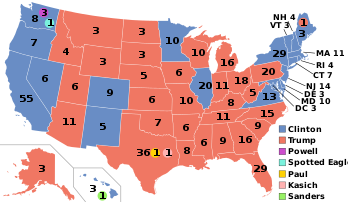

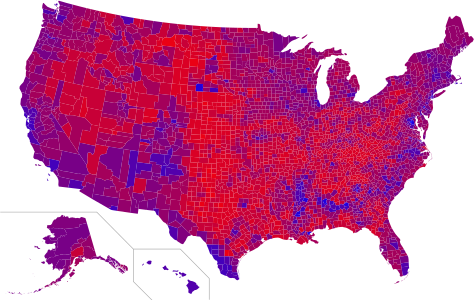

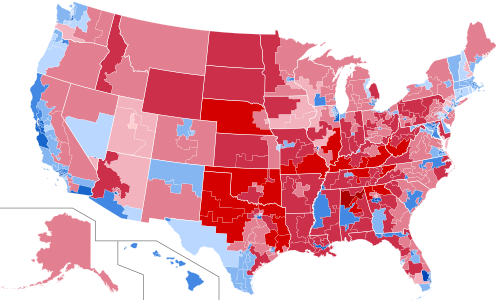

Following the national presidential election day in the first week of November, each state counts its popular votes pursuant to that state’s laws to designate presidential electors. State electors meet in their respective state capitals in December to cast their votes. The results are certified by the states and D.C. to Congress, where they are tabulated nationally in the first week of January before a joint meeting of the Senate and House of Representatives. If a majority of votes are not cast for a candidate, the House resolves itself into a presidential election session with one presidential vote assigned to each of the fifty state delegations, excluding the District of Columbia. The elected president and vice president are inaugurated on January 20. While the electoral vote has given the same result as the popular vote in most elections, this has not been the case in a few elections, including the 2000 and 2016 elections.

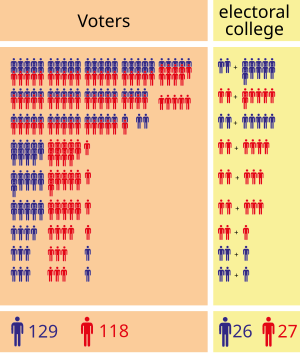

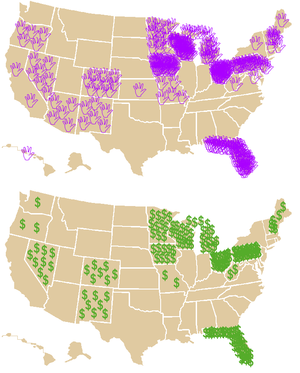

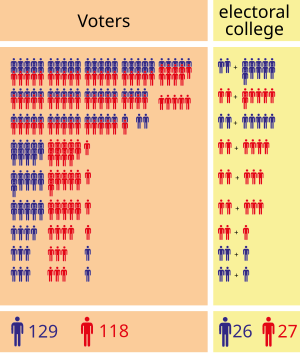

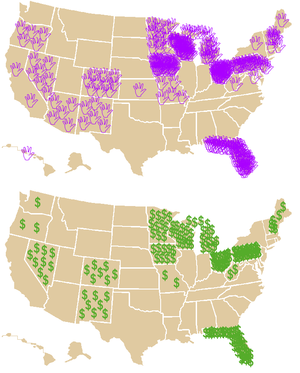

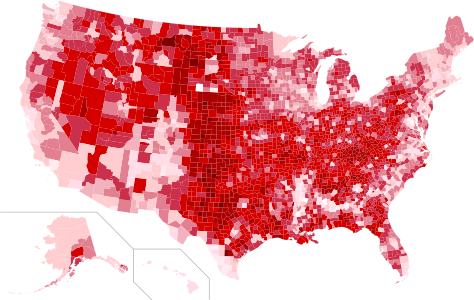

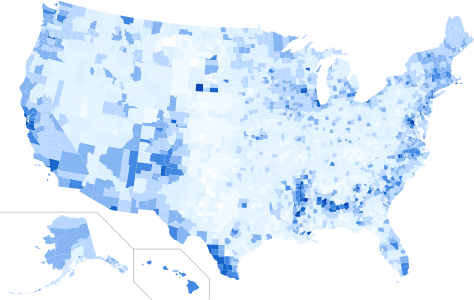

The Electoral College system is a matter of ongoing debate, with some defending it and others calling for its abolition. Supporters of the Electoral College argue that it is fundamental to American federalism, that it requires candidates to appeal to voters outside large cities, increases the political influence of small states, discourages the excessive growth of political parties and preserves the two-party system, and makes the electoral outcome appear more legitimate than that of a nationwide popular vote.[5] Opponents of the Electoral College argue that it can result in a person becoming president even though an opponent got more votes (which occurred in two of the five presidential elections from 2000 to 2016); that it causes candidates to focus their campaigning disproportionately in a few “swing states” while ignoring most areas of the country; and that its allocation of Electoral College votes gives citizens in less populated rural states as much as four times the voting power as those in more populous urban states.[6][7][8][9][10]Polls since 1967 have shown that a majority of Americans favor the president and vice president being elected by the nationwide popular vote, instead of by the Electoral College.[11][12]

Background

The Constitutional Convention in 1787 used the Virginia Plan as the basis for discussions, as the Virginia proposal was the first. The Virginia Plan called for the Congress to elect the president.[13] Delegates from a majority of states agreed to this mode of election. After being debated, however, delegates came to oppose nomination by congress for the reason that it could violate the separation of powers. James Wilson then made motion for electors for the purpose of choosing the president.[14]

Later in the convention, a committee formed to work out various details including the mode of election of the president, including final recommendations for the electors, a group of people apportioned among the states in the same numbers as their representatives in Congress (the formula for which had been resolved in lengthy debates resulting in the Connecticut Compromise and Three-Fifths Compromise), but chosen by each state “in such manner as its Legislature may direct.” Committee member Gouverneur Morris explained the reasons for the change; among others, there were fears of “intrigue” if the president were chosen by a small group of men who met together regularly, as well as concerns for the independence of the president if he were elected by the Congress.[15]

However, once the Electoral College had been decided on, several delegates (Mason, Butler, Morris, Wilson, and Madison) openly recognized its ability to protect the election process from cabal, corruption, intrigue, and faction. Some delegates, including James Wilson and James Madison, preferred popular election of the executive. Madison acknowledged that while a popular vote would be ideal, it would be difficult to get consensus on the proposal given the prevalence of slavery in the South:

There was one difficulty however of a serious nature attending an immediate choice by the people. The right of suffrage was much more diffusive in the Northern than the Southern States; and the latter could have no influence in the election on the score of Negroes. The substitution of electors obviated this difficulty and seemed on the whole to be liable to the fewest objections.[16]

The Convention approved the Committee’s Electoral College proposal, with minor modifications, on September 6, 1787.[17] Delegates from states with smaller populations or limited land area such as Connecticut, New Jersey, and Maryland generally favored the Electoral College with some consideration for states.[18] At the compromise providing for a runoff among the top five candidates, the small states supposed that the House of Representatives with each state delegation casting one vote would decide most elections.[19]

In The Federalist Papers, James Madison explained his views on the selection of the president and the Constitution. In Federalist No. 39, Madison argued the Constitution was designed to be a mixture of state-based and population-based government. Congress would have two houses: the state-based Senate and the population-based House of Representatives. Meanwhile, the president would be elected by a mixture of the two modes.[20]

Alexander Hamilton in Federalist No. 68 laid out what he believed were the key advantages to the Electoral College. The electors come directly from the people and them alone for that purpose only, and for that time only. This avoided a party-run legislature, or a permanent body that could be influenced by foreign interests before each election.[21] Hamilton explained the election was to take place among all the states, so no corruption in any state could taint “the great body of the people” in their selection. The choice was to be made by a majority of the Electoral College, as majority rule is critical to the principles of republican government. Hamilton argued that electors meeting in the state capitals were able to have information unavailable to the general public. Hamilton also argued that since no federal officeholder could be an elector, none of the electors would be beholden to any presidential candidate.[21]

Another consideration was the decision would be made without “tumult and disorder” as it would be a broad-based one made simultaneously in various locales where the decision-makers could deliberate reasonably, not in one place where decision-makers could be threatened or intimidated. If the Electoral College did not achieve a decisive majority, then the House of Representatives was to choose the president from among the top five candidates,[22] ensuring selection of a presiding officer administering the laws would have both ability and good character. Hamilton was also concerned about somebody unqualified, but with a talent for “low intrigue, and the little arts of popularity” attaining high office.[21]

Additionally, in the Federalist No. 10, James Madison argued against “an interested and overbearing majority” and the “mischiefs of faction” in an electoral system. He defined a faction as “a number of citizens whether amounting to a majority or minority of the whole, who are united and actuated by some common impulse of passion, or of interest, adverse to the rights of other citizens, or to the permanent and aggregate interests of the community.” What was then called republican government (i.e., representative democracy, as opposed to direct democracy) combined with the principles of federalism (with distribution of voter rights and separation of government powers) would countervail against factions. Madison further postulated in the Federalist No. 10 that the greater the population and expanse of the Republic, the more difficulty factions would face in organizing due to such issues as sectionalism.[23]

Although the United States Constitution refers to “Electors” and “electors”, neither the phrase “Electoral College” nor any other name is used to describe the electors collectively. It was not until the early 19th century the name “Electoral College” came into general usage as the collective designation for the electors selected to cast votes for president and vice president. The phrase was first written into federal law in 1845 and today the term appears in 3 U.S.C. § 4, in the section heading and in the text as “college of electors.”[24]

History

Historically, the state legislatures chose the electors in more than half the states. That practice changed during the early 19th century, as states extended the right to vote to wider segments of the population. By 1832, only South Carolina had not transitioned to popular election. Since 1880, the electors in every state have been chosen based on a popular election held on Election Day.[1] The popular election for electors means the president and vice president are in effect chosen through indirect election by the citizens.[25] Since the mid-19th century when all electors have been popularly chosen, the Electoral College has elected the candidate who received the most popular votes nationwide, except in four elections: 1876, 1888, 2000, and 2016. In 1824, there were six states in which electors were legislatively appointed, rather than popularly elected, so the true national popular vote is uncertain; the electors failed to select a winning candidate, so the matter was decided by the House of Representatives.[26]

Original plan

Article II, Section 1, Clause 2 of the Constitution states:

Each State shall appoint, in such Manner as the Legislature thereof may direct, a Number of Electors, equal to the whole Number of Senators and Representatives to which the State may be entitled in the Congress: but no Senator or Representative, or Person holding an Office of Trust or Profit under the United States, shall be appointed an Elector.

Article II, Section 1, Clause 4 of the Constitution states:

The Congress may determine the Time of chusing [sic] the Electors, and the Day on which they shall give their Votes; which Day shall be the same throughout the United States.

Article II, Section 1, Clause 3 of the Constitution provided the original plan by which the electors voted for president. Under the original plan, each elector cast two votes for president; electors did not vote for vice president. Whoever received a majority of votes from the electors would become president, with the person receiving the second most votes becoming vice president.

The original plan of the Electoral College was based upon several assumptions and anticipations of the Framers of the Constitution:[27]

- Choice of the president should reflect the “sense of the people” at a particular time, not the dictates of a cabal in a “pre-established body” such as Congress or the State legislatures, and independent of the influence of “foreign powers”.[28]

- The choice would be made decisively with a “full and fair expression of the public will” but also maintaining “as little opportunity as possible to tumult and disorder”.[29]

- Individual electors would be elected by citizens on a district-by-district basis. Voting for president would include the widest electorate allowed in each state.[30]

- Each presidential elector would exercise independent judgment when voting, deliberating with the most complete information available in a system that over time, tended to bring about a good administration of the laws passed by Congress.[31]

- Candidates would not pair together on the same ticket with assumed placements toward each office of president and vice president.

- The system as designed would rarely produce a winner, thus sending the presidential election to the House of Representatives.

According to the text of Article II, however, each state government was free to have its own plan for selecting its electors, and the Constitution does not explicitly require states to popularly elect their electors. Several methods for selecting electors are described below.

Breakdown and revision

The emergence of political parties and nationally coordinated election campaigns soon complicated matters in the elections of 1796 and 1800. In 1796, Federalist Party candidate John Adams won the presidential election. Finishing in second place was Democratic-Republican Party candidate Thomas Jefferson, the Federalists’ opponent, who became the vice president. This resulted in the president and vice president being of different political parties.

In 1800, the Democratic-Republican Party again nominated Jefferson for president and also nominated Aaron Burr for vice president. After the election, Jefferson and Burr tied one another with 73 electoral votes each. Since ballots did not distinguish between votes for president and votes for vice president, every ballot cast for Burr technically counted as a vote for him to become president, despite Jefferson clearly being his party’s first choice. Lacking a clear winner by constitutional standards, the election had to be decided by the House of Representatives pursuant to the Constitution’s contingency election provision.

Having already lost the presidential contest, Federalist Party representatives in the lame duck House session seized upon the opportunity to embarrass their opposition by attempting to elect Burr over Jefferson. The House deadlocked for 35 ballots as neither candidate received the necessary majority vote of the state delegations in the House (the votes of nine states were needed for a conclusive election). Jefferson achieved electoral victory on the 36th ballot, but only after Federalist Party leader Alexander Hamilton—who disfavored Burr’s personal character more than Jefferson’s policies—had made known his preference for Jefferson.

Responding to the problems from those elections, the Congress proposed on December 9, 1803, and three-fourths of the states ratified by June 15, 1804, the Twelfth Amendment. Starting with the 1804 election, the amendment requires electors cast separate ballots for president and vice president, replacing the system outlined in Article II, Section 1, Clause 3.

Evolution to the general ticket

Alexander Hamilton described the Founding Fathers’ view of how electors would be chosen:

A small number of persons, selected by their fellow-citizens from the general mass, will be most likely to possess the information and discernment requisite to such complicated [tasks].[32]

They assumed this would take place district by district. That plan was carried out by many states until the 1880s. For example, in Massachusetts in 1820, the rule stated “the people shall vote by ballot, on which shall be designated who is voted for as an Elector for the district.”[33] In other words, the people did not place the name of a candidate for a president on the ballot, instead they voted for their local elector, whom they trusted later to cast a responsible vote for president.

Some states reasoned that the favorite presidential candidate among the people in their state would have a much better chance if all of the electors selected by their state were sure to vote the same way—a “general ticket” of electors pledged to a party candidate.[34] So the slate of electors chosen by the state were no longer free agents, independent thinkers, or deliberative representatives. They became “voluntary party lackeys and intellectual non-entities.”[35] Once one state took that strategy, the others felt compelled to follow suit in order to compete for the strongest influence on the election.[34]

When James Madison and Hamilton, two of the most important architects of the Electoral College, saw this strategy being taken by some states, they protested strongly. Madison and Hamilton both made it clear this approach violated the spirit of the Constitution. According to Hamilton, the selection of the president should be “made by men most capable of analyzing the qualities adapted to the station [of president].”[32] According to Hamilton, the electors were to analyze the list of potential presidents and select the best one. He also used the term “deliberate”. Hamilton considered a pre-pledged elector to violate the spirit of Article II of the Constitution insofar as such electors could make no “analysis” or “deliberate” concerning the candidates. Madison agreed entirely, saying that when the Constitution was written, all of its authors assumed individual electors would be elected in their districts and it was inconceivable a “general ticket” of electors dictated by a state would supplant the concept. Madison wrote to George Hay:

The district mode was mostly, if not exclusively in view when the Constitution was framed and adopted; & was exchanged for the general ticket [many years later].[36]

The Founding Fathers assumed that electors would be elected by the citizens of their district and that elector was to be free to analyze and deliberate regarding who is best suited to be president.

Madison and Hamilton were so upset by what they saw as a distortion of the original intent that they advocated a constitutional amendment to prevent anything other than the district plan: “the election of Presidential Electors by districts, is an amendment very proper to be brought forward,” Madison told George Hay in 1823.[36] Hamilton went further. He actually drafted an amendment to the Constitution mandating the district plan for selecting electors.[37]

Evolution of selection plans

In 1789, at-large popular vote, the winner-take-all method, began with Pennsylvania and Maryland; Virginia and Delaware used a district plan by popular vote, and in the five other states participating in the election (Connecticut, Georgia, Maryland, New Hampshire, New Jersey, and South Carolina),[38] state legislatures chose. By 1800, Virginia and Rhode Island voted at-large, Kentucky, Maryland, and North Carolina voted popularly by district, and eleven states voted by state legislature. Beginning in 1804 there was a definite trend towards the winner-take-all system for statewide popular vote.[39]

By 1832, only South Carolina chose their electors this way, and it abandoned the method after 1860.[39] States using popular vote by district have included ten states from all regions of the country. By 1832, there was only Maryland, and from 1836 district plans fell out of use until the 20th century, though Michigan used a district plan for 1892 only.[40]

Since 1836, statewide winner-take-all popular voting for electors has been the almost universal practice. As of 2016, Maine (from 1972) and Nebraska (from 1996) use the district plan, with two at-large electors assigned to support the winner of the statewide popular vote.[41]

Fourteenth Amendment

Section 2 of the Fourteenth Amendment allows for a state’s representation in the House of Representatives to be reduced if a state unconstitutionally denies people the right to vote. The reduction is in keeping with the proportion of people denied a vote. This amendment refers to “the right to vote at any election for the choice of electors for President and Vice President of the United States” among other elections, the only place in the Constitution mentioning electors being selected by popular vote.

On May 8, 1866, during a debate on the Fourteenth Amendment, Thaddeus Stevens, the leader of the Republicans in the House of Representatives, delivered a speech on the amendment’s intent. Regarding Section 2, he said:[42]

The second section I consider the most important in the article. It fixes the basis of representation in Congress. If any State shall exclude any of her adult male citizens from the elective franchise, or abridge that right, she shall forfeit her right to representation in the same proportion. The effect of this provision will be either to compel the States to grant universal suffrage or so shear them of their power as to keep them forever in a hopeless minority in the national Government, both legislative and executive.[43]

Federal law (2 U.S.C. § 6) implements Section 2’s mandate.

Meeting of electors

Since 1936, federal law has provided that the electors in all the states and the District of Columbia, meet “on the first Monday after the second Wednesday in December next following their appointment” to vote for president and vice president.[44][45]

Under Article II, Section 1, Clause 2, all elected and appointed federal officials are prohibited from being electors. The Office of the Federal Register is charged with administering the Electoral College.[46]

After the vote, each state then sends a certified record of their electoral votes to Congress. The votes of the electors are opened during a joint session of Congress, held in the first week of January, and read aloud by the incumbent vice president, acting in his capacity as President of the Senate. If any person received an absolute majority of electoral votes that person is declared the winner.[47] If there is a tie, or if no candidate for either or both offices receives a majority, then choice falls to Congress in a procedure known as contingent election.

Modern mechanics

The 2012 Certificate of Vote issued by Maryland’s delegation to the Electoral College

Summary

Even though the aggregate national popular vote is calculated by state officials, media organizations, and the Federal Election Commission, the people only indirectly elect the president, as the national popular vote is not the basis for electing the president or vice president. The president and vice president of the United States are elected by the Electoral College, which consists of 538 presidential electors from the fifty states and Washington, D.C.Presidential electors are selected on a state-by-state basis, as determined by the laws of each state. Since the election of 1824,[48] most states have appointed their electors on a winner-take-all basis, based on the statewide popular vote on Election Day. Maine and Nebraska are the only two current exceptions, as both states use the congressional district method. Although ballots list the names of the presidential and vice presidential candidates (who run on a ticket), voters actually choose electors when they vote for president and vice president. These presidential electors in turn cast electoral votes for those two offices. Electors usually pledge to vote for their party’s nominee, but some “faithless electors” have voted for other candidates or refrained from voting.

A candidate must receive an absolute majority of electoral votes (currently 270) to win the presidency or the vice presidency. If no candidate receives a majority in the election for president or vice president, the election is determined via a contingency procedure established by the Twelfth Amendment. In such a situation, the House chooses one of the top three presidential electoral vote-winners as the president, while the Senate chooses one of the top two vice presidential electoral vote-winners as vice president.

Electors

Apportionment

State population per electoral vote for the 50 states and Washington D.C.

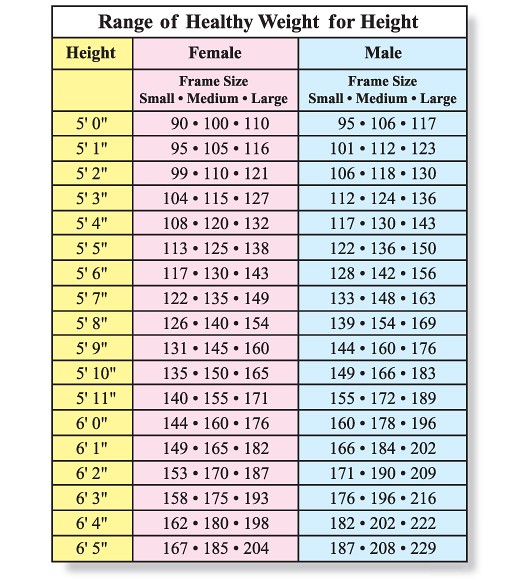

A state’s number of electors equals the number of representatives plus two electors for both senators the state has in the United States Congress.[49][50] The number of representatives is based on the respective populations, determined every 10 years by the United States Census. Each representative represents on average 711,000 persons.[51]

Under the Twenty-third Amendment, Washington, D.C., is allocated as many electors as it would have if it were a state, but no more electors than the least populous state. The least populous state (which is Wyoming, according to the 2010 census) has three electors; thus, D.C. cannot have more than three electors. Even if D.C. were a state, its population would entitle it to only three electors; based on its population per electoral vote, D.C. has the second highest per capita Electoral College representation, after Wyoming.[52]

Currently, there are 538 electors; based on 435 representatives, 100 senators, and three electors allocated to Washington, D.C. The six states with the most electors are California (55), Texas (38), New York (29), Florida (29), Illinois (20), and Pennsylvania (20). The seven least populous states—Alaska, Delaware, Montana, North Dakota, South Dakota, Vermont, and Wyoming—have three electors each. This is because each of these states has one representative and two senators.

Nomination

The custom of allowing recognized political parties to select a slate of prospective electors developed early. In contemporary practice, each presidential-vice presidential ticket has an associated slate of potential electors. Then on Election Day, the voters select a ticket and thereby select the associated electors.[1]

Candidates for elector are nominated by state chapters of nationally oriented political parties in the months prior to Election Day. In some states, the electors are nominated by voters in primaries, the same way other presidential candidates are nominated. In some states, such as Oklahoma, Virginia and North Carolina, electors are nominated in party conventions. In Pennsylvania, the campaign committee of each candidate names their respective electoral college candidates (an attempt to discourage faithless electors). Varying by state, electors may also be elected by state legislatures, or appointed by the parties themselves.[53]

Selection

Article II, Section 1, Clause 2 of the Constitution requires each state legislature to determine how electors for the state are to be chosen, but it disqualifies any person holding a federal office, either elected or appointed, from being an elector.[54] Under Section 3 of the Fourteenth Amendment, any person who has sworn an oath to support the United States Constitution in order to hold either a state or federal office, and later rebelled against the United States directly or by giving assistance to those doing so, is disqualified from being an elector. However, the Congress may remove this disqualification by a two-thirds vote in each House.

Since the Civil War, all states have chosen presidential electors by popular vote. This process has been normalized to the point the names of the electors appear on the ballot in only eight states: Rhode Island, Tennessee, Louisiana, Arizona, Idaho, Oklahoma, North Dakota and South Dakota.[55][56]

Since 1996, all but two states have followed the winner takes all method of allocating electors by which every person named on the slate for the ticket winning the statewide popular vote are named as presidential electors.[57][58] Maine and Nebraska are the only states not using this method. In those states, the winner of the popular vote in each of its congressional districts is awarded one elector, and the winner of the statewide vote is then awarded the state’s remaining two electors.[57][59]

The Tuesday following the first Monday in November has been fixed as the day for holding federal elections, called the Election Day.[60] In 48 states and Washington, D.C., the “winner-takes-all method” is used (electors selected as a single bloc). Maine and Nebraska use the “congressional district method”, selecting one elector within each congressional district by popular vote and selecting the remaining two electors by a statewide popular vote. This method has been used in Maine since 1972 and in Nebraska since 1996.[61]

The current system of choosing electors is called the “short ballot”. In most states, voters choose a slate of electors, and only a few states list on the ballot the names of proposed electors. In some states, if a voter wants to write in a candidate for president, the voter is also required to write in the names of proposed electors.

After the election, each state prepares seven Certificates of Ascertainment, each listing the candidates for president and vice president, their pledged electors, and the total votes each candidacy received.[62] One certificate is sent, as soon after Election Day as practicable, to the National Archivist in Washington D.C. The Certificates of Ascertainment are mandated to carry the State Seal, and the signature of the Governor (in the case of the District of Columbia, the Certificate is signed by the Mayor of the District of Columbia.[63])

Meetings

The Electoral College never meets as one body. Electors meet in their respective state capitals (electors for the District of Columbia meet within the District) on the Monday after the second Wednesday in December, at which time they cast their electoral votes on separate ballots for president and vice president.[64][65][66]

Although procedures in each state vary slightly, the electors generally follow a similar series of steps, and the Congress has constitutional authority to regulate the procedures the states follow. The meeting is opened by the election certification official – often that state’s secretary of state or equivalent – who reads the Certificate of Ascertainment. This document sets forth who was chosen to cast the electoral votes. The attendance of the electors is taken and any vacancies are noted in writing. The next step is the selection of a president or chairman of the meeting, sometimes also with a vice chairman. The electors sometimes choose a secretary, often not himself an elector, to take the minutes of the meeting. In many states, political officials give short speeches at this point in the proceedings.

When the time for balloting arrives, the electors choose one or two people to act as tellers. Some states provide for the placing in nomination of a candidate to receive the electoral votes (the candidate for president of the political party of the electors). Each elector submits a written ballot with the name of a candidate for president. In New Jersey, the electors cast ballots by checking the name of the candidate on a pre-printed card; in North Carolina, the electors write the name of the candidate on a blank card. The tellers count the ballots and announce the result. The next step is the casting of the vote for vice president, which follows a similar pattern.

Each state’s electors must complete six Certificates of Vote. Each Certificate of Vote must be signed by all of the electors and a Certificate of Ascertainment must be attached to each of the Certificates of Vote. Each Certificate of Vote must include the names of those who received an electoral vote for either the office of president or of vice president. The electors certify the Certificates of Vote and copies of the Certificates are then sent in the following fashion:[67]

A staff member of the President of the Senate collects the Certificates of Vote as they arrive and prepares them for the joint session of the Congress. The Certificates are arranged – unopened – in alphabetical order and placed in two special mahogany boxes. Alabama through Missouri (including the District of Columbia) are placed in one box and Montana through Wyoming are placed in the other box.[68] Before 1950, the Secretary of State’s office oversaw the certifications, but since then the Office of Federal Register in the Archivist’s office reviews them to make sure the documents sent to the archive and Congress match and that all formalities have been followed, sometimes requiring states to correct the documents.[46]

Faithlessness

An elector may vote for whomever he or she wishes for each office provided that at least one of their votes (president or vice president) is for a person who is not a resident of the same state as themselves.[69] But “faithless electors” are those who either cast electoral votes for someone other than the candidate of the party that they pledged to vote for or who abstain. Twenty-nine states plus the District of Columbia have passed laws to punish faithless electors, although none have ever been enforced. Many constitutional scholars claim that state restrictions would be struck down if challenged based on Article II and the Twelfth Amendment.[70] In 1952, the constitutionality of state pledge laws was brought before the Supreme Court in Ray v. Blair, 343 U.S. 214 (1952).

Some states, however, do have laws requiring that state’s electors to vote for the candidate to whom they are pledged. Electors who break their pledge are called “faithless electors.” Only once, in 1836, has an election’s outcome been influenced by faithless electors. In that instance, Virginia’s 23 electors were pledged to vote for Richard Mentor Johnson to be vice-president, but instead voted for former South Carolina senator William Smith, leaving Johnson one vote short of the majority needed to be elected. In accordance with the Twelfth Amendment, the Senate then chose between the top two receivers of electoral votes for vice-president, electing Johnson on the first ballot. Over the course of 58 presidential elections since 1789, only 0.67% of all electors have been unfaithful.[71]

The Court ruled in favor of state laws requiring electors to pledge to vote for the winning candidate, as well as removing electors who refuse to pledge. As stated in the ruling, electors are acting as a functionary of the state, not the federal government. Therefore, states have the right to govern the process of choosing electors. The constitutionality of state laws punishing electors for actually casting a faithless vote, rather than refusing to pledge, has never been decided by the Supreme Court. However, in his dissent in Ray v. Blair, Justice Robert Jackson wrote: “no one faithful to our history can deny that the plan originally contemplated what is implicit in its text—that electors would be free agents, to exercise an independent and nonpartisan judgment as to the men best qualified for the Nation’s highest offices.”

While many laws punish a faithless elector only after the fact, states like Michigan also specify a faithless elector’s vote be voided.[72]

As electoral slates are typically chosen by the political party or the party’s presidential nominee, electors usually have high loyalty to the party and its candidate: a faithless elector runs a greater risk of party censure than of criminal charges.

In 2000, elector Barbara Lett-Simmons of Washington, D.C., chose not to vote, rather than voting for Al Gore as she had pledged to do.[73] In 2016, seven electors voted contrary to their pledges. Faithless electors have never changed the outcome of any presidential election.[74]

Joint session of Congress

The Twelfth Amendment mandates Congress assemble in joint session to count the electoral votes and declare the winners of the election.[75] The session is ordinarily required to take place on January 6 in the calendar year immediately following the meetings of the presidential electors.[76] Since the Twentieth Amendment, the newly elected Congress declares the winner of the election; all elections before 1936 were determined by the outgoing House.

The Office of the Federal Register is charged with administering the Electoral College.[46] The meeting is held at 1 p.m. in the Chamber of the U.S. House of Representatives.[76] The sitting vice president is expected to preside, but in several cases the president pro tempore of the Senate has chaired the proceedings. The vice president and the Speaker of the House sit at the podium, with the vice president in the seat of the Speaker of the House. Senate pages bring in the two mahogany boxes containing each state’s certified vote and place them on tables in front of the senators and representatives. Each house appoints two tellers to count the vote (normally one member of each political party). Relevant portions of the Certificate of Vote are read for each state, in alphabetical order.

Members of Congress can object to any state’s vote count, provided objection is presented in writing and is signed by at least one member of each house of Congress. An objection supported by at least one senator and one representative will be followed by the suspension of the joint session and by separate debates and votes in each House of Congress; after both Houses deliberate on the objection, the joint session is resumed. A state’s certificate of vote can be rejected only if both Houses of Congress vote to accept the objection. In that case, the votes from the State in question are simply ignored. The votes of Arkansas and Louisiana were rejected in the presidential election of 1872.[77]

Objections to the electoral vote count are rarely raised, although it did occur during the vote count in 2001 after the close 2000 presidential election between Governor George W. Bush of Texas and the vice president of the United States, Al Gore. Gore, who as vice president was required to preside over his own Electoral College defeat (by five electoral votes), denied the objections, all of which were raised by only several representatives and would have favored his candidacy, after no senators would agree to jointly object. Objections were again raised in the vote count of the 2004 elections, and on that occasion the document was presented by one representative and one senator. Although the joint session was suspended, the objections were quickly disposed of and rejected by both Houses of Congress. If there are no objections or all objections are overruled, the presiding officer simply includes a state’s votes, as declared in the certificate of vote, in the official tally.

After the certificates from all states are read and the respective votes are counted, the presiding officer simply announces the final result of the vote and, provided the required absolute majority of votes was achieved, declares the names of the persons elected president and vice president. This announcement concludes the joint session and formalizes the recognition of the president-elect and of the vice president-elect. The senators then depart from the House Chamber. The final tally is printed in the Senate and House journals.

Contingencies

Contingent presidential election by House

The Twelfth Amendment requires the House of Representatives to go into session immediately to vote for a president if no candidate for president receives a majority of the electoral votes (since 1964, 270 of the 538 electoral votes).

In this event, the House of Representatives is limited to choosing from among the three candidates who received the most electoral votes for president. Each state delegation votes en bloc—each delegation having a single vote; the District of Columbia does not get to vote. A candidate must receive an absolute majority of state delegation votes (i.e., at present, a minimum of 26 votes) in order for that candidate to become the president-elect. Additionally, delegations from at least two thirds of all the states must be present for voting to take place. The House continues balloting until it elects a president.

The House of Representatives has chosen the president only twice: in 1801 under Article II, Section 1, Clause 3; and in 1825 under the Twelfth Amendment.

Contingent vice presidential election by Senate

If no candidate for vice president receives an absolute majority of electoral votes, then the Senate must go into session to elect a vice president. The Senate is limited to choosing from the two candidates who received the most electoral votes for vice president. Normally this would mean two candidates, one less than the number of candidates available in the House vote. However, the text is written in such a way that all candidates with the most and second most electoral votes are eligible for the Senate election – this number could theoretically be larger than two. The Senate votes in the normal manner in this case (i.e., ballots are individually cast by each senator, not by state delegations). However, two-thirds of the senators must be present for voting to take place.

Additionally, the Twelfth Amendment states a “majority of the whole number” of senators (currently 51 of 100) is necessary for election.[78] Further, the language requiring an absolute majority of Senate votes precludes the sitting vice president from breaking any tie that might occur,[79] although some academics and journalists have speculated to the contrary.[80]

The only time the Senate chose the vice president was in 1837. In that instance, the Senate adopted an alphabetical roll call and voting aloud. The rules further stated, “[I]f a majority of the number of senators shall vote for either the said Richard M. Johnson or Francis Granger, he shall be declared by the presiding officer of the Senate constitutionally elected Vice President of the United States”; the Senate chose Johnson.[81]

Deadlocked election

Section 3 of the Twentieth Amendment specifies if the House of Representatives has not chosen a president-elect in time for the inauguration (noon EST on January 20), then the vice president-elect becomes acting president until the House selects a president. Section 3 also specifies Congress may statutorily provide for who will be acting president if there is neither a president-elect nor a vice president-elect in time for the inauguration. Under the Presidential Succession Act of 1947, the Speaker of the House would become acting president until either the House selects a president or the Senate selects a vice president. Neither of these situations has ever occurred.

Current electoral vote distribution

Electoral votes (EV) allocations for the 2012, 2016 and 2020 presidential elections.[82]

Triangular markers (

) indicate gains or losses following the 2010 Census.[83]

) indicate gains or losses following the 2010 Census.[83]

| EV × States |

States* |

| 55 × 1 = 55 |

California |

| 38 × 1 = 38 |

Texas Texas |

| 29 × 2 = 58 |

Florida, Florida,   New York New York |

| 20 × 2 = 40 |

Illinois, Illinois,  Pennsylvania Pennsylvania |

| 18 × 1 = 18 |

Ohio Ohio |

| 16 × 2 = 32 |

Georgia, Georgia,  Michigan Michigan |

| 15 × 1 = 15 |

North Carolina |

| 14 × 1 = 14 |

New Jersey New Jersey |

| 13 × 1 = 13 |

Virginia |

| 12 × 1 = 12 |

Washington Washington |

| 11 × 4 = 44 |

Arizona, Indiana, Arizona, Indiana,  Massachusetts, Tennessee Massachusetts, Tennessee |

| 10 × 4 = 40 |

Maryland, Minnesota,  Missouri, Wisconsin Missouri, Wisconsin |

| 9 × 3 = 27 |

Alabama, Colorado,  South Carolina South Carolina |

| 8 × 2 = 16 |

Kentucky,  Louisiana Louisiana |

| 7 × 3 = 21 |

Connecticut, Oklahoma, Oregon |

| 6 × 6 = 36 |

Arkansas,  Iowa, Kansas, Mississippi, Iowa, Kansas, Mississippi,  Nevada, Nevada,  Utah Utah |

| 5 × 3 = 15 |

Nebraska**, New Mexico, West Virginia |

| 4 × 5 = 20 |

Hawaii, Idaho, Maine**, New Hampshire, Rhode Island |

| 3 × 8 = 24 |

Alaska, Delaware, District of Columbia*, Montana, North Dakota, South Dakota, Vermont, Wyoming |

| = 538 |

Total electors |

- * The Twenty-third Amendment grants electors to DC as if it were a state, but not more than the least populous state. This has always been three.

- ** Maine’s four electors and Nebraska’s five are distributed using the Congressional district method.

Chronological table

Number of presidential electors by state and year

Election

year |

1788–1800 |

1804–1900 |

1904–2000 |

2004– |

| ’88 |

’92 |

’96

’00 |

’04

’08 |

’12 |

’16 |

’20 |

’24

’28 |

’32 |

’36

’40 |

’44 |

’48 |

’52

’56 |

’60 |

’64 |

’68 |

’72 |

’76

’80 |

’84

’88 |

’92 |

’96

’00 |

’04 |

’08 |

’12

’16

’20

’24

’28 |

’32

’36

’40 |

’44

’48 |

’52

’56 |

’60 |

’64

’68 |

’72

’76

’80 |

’84

’88 |

’92

’96

’00 |

’04

’08 |

’12

’16

’20 |

| # |

Total |

81 |

135 |

138 |

176 |

218 |

221 |

235 |

261 |

288 |

294 |

275 |

290 |

296 |

303 |

234 |

294 |

366 |

369 |

401 |

444 |

447 |

476 |

483 |

531 |

537 |

538 |

| 22 |

Alabama |

|

|

|

|

|

|

3 |

5 |

7 |

7 |

9 |

9 |

9 |

9 |

0 |

8 |

10 |

10 |

10 |

11 |

11 |

11 |

11 |

12 |

11 |

11 |

11 |

11 |

10 |

9 |

9 |

9 |

9 |

9 |

| 49 |

Alaska |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

3 |

3 |

3 |

3 |

| 48 |

Arizona |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

4 |

4 |

4 |

5 |

6 |

7 |

8 |

10 |

11 |

| 25 |

Arkansas |

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

4 |

4 |

0 |

5 |

6 |

6 |

7 |

8 |

8 |

9 |

9 |

9 |

9 |

9 |

8 |

8 |

6 |

6 |

6 |

6 |

6 |

6 |

| 31 |

California |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

4 |

5 |

5 |

6 |

6 |

8 |

9 |

9 |

10 |

10 |

13 |

22 |

25 |

32 |

32 |

40 |

45 |

47 |

54 |

55 |

55 |

| 38 |

Colorado |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

4 |

4 |

5 |

5 |

6 |

6 |

6 |

6 |

6 |

6 |

7 |

8 |

8 |

9 |

9 |

| 5 |

Connecticut |

7 |

9 |

9 |

9 |

9 |

9 |

9 |

8 |

8 |

8 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

7 |

7 |

7 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

7 |

7 |

| – |

D.C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

3 |

3 |

3 |

| 1 |

Delaware |

3 |

3 |

3 |

3 |

4 |

4 |

4 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

| 27 |

Florida |

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

0 |

3 |

4 |

4 |

4 |

4 |

4 |

5 |

5 |

6 |

7 |

8 |

10 |

10 |

14 |

17 |

21 |

25 |

27 |

29 |

| 4 |

Georgia |

5 |

4 |

4 |

6 |

8 |

8 |

8 |

9 |

11 |

11 |

10 |

10 |

10 |

10 |

0 |

9 |

11 |

11 |

12 |

13 |

13 |

13 |

13 |

14 |

12 |

12 |

12 |

12 |

12 |

12 |

12 |

13 |

15 |

16 |

| 50 |

Hawaii |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

4 |

4 |

4 |

4 |

4 |

4 |

| 43 |

Idaho |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

3 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

| 21 |

Illinois |

|

|

|

|

|

|

3 |

3 |

5 |

5 |

9 |

9 |

11 |

11 |

16 |

16 |

21 |

21 |

22 |

24 |

24 |

27 |

27 |

29 |

29 |

28 |

27 |

27 |

26 |

26 |

24 |

22 |

21 |

20 |

| 19 |

Indiana |

|

|

|

|

|

3 |

3 |

5 |

9 |

9 |

12 |

12 |

13 |

13 |

13 |

13 |

15 |

15 |

15 |

15 |

15 |

15 |

15 |

15 |

14 |

13 |

13 |

13 |

13 |

13 |

12 |

12 |

11 |

11 |

| 29 |

Iowa |

|

|

|

|

|

|

|

|

|

|

|

4 |

4 |

4 |

8 |

8 |

11 |

11 |

13 |

13 |

13 |

13 |

13 |

13 |

11 |

10 |

10 |

10 |

9 |

8 |

8 |

7 |

7 |

6 |

| 34 |

Kansas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

5 |

5 |

9 |

10 |

10 |

10 |

10 |

10 |

9 |

8 |

8 |

8 |

7 |

7 |

7 |

6 |

6 |

6 |

| 15 |

Kentucky |

|

4 |

4 |

8 |

12 |

12 |

12 |

14 |

15 |

15 |

12 |

12 |

12 |

12 |

11 |

11 |

12 |

12 |

13 |

13 |

13 |

13 |

13 |

13 |

11 |

11 |

10 |

10 |

9 |

9 |

9 |

8 |

8 |

8 |

| 18 |

Louisiana |

|

|

|

|

3 |

3 |

3 |

5 |

5 |

5 |

6 |

6 |

6 |

6 |

0 |

7 |

8 |

8 |

8 |

8 |

8 |

9 |

9 |

10 |

10 |

10 |

10 |

10 |

10 |

10 |

10 |

9 |

9 |

8 |

| 23 |

Maine |

|

|

|

|

|

|

9 |

9 |

10 |

10 |

9 |

9 |

8 |

8 |

7 |

7 |

7 |

7 |

6 |

6 |

6 |

6 |

6 |

6 |

5 |

5 |

5 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

| 7 |

Maryland |

8 |

10 |

10 |

11 |

11 |

11 |

11 |

11 |

10 |

10 |

8 |

8 |

8 |

8 |

7 |

7 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

9 |

9 |

10 |

10 |

10 |

10 |

10 |

10 |

| 6 |

Massachusetts |

10 |

16 |

16 |

19 |

22 |

22 |

15 |

15 |

14 |

14 |

12 |

12 |

13 |

13 |

12 |

12 |

13 |

13 |

14 |

15 |

15 |

16 |

16 |

18 |

17 |

16 |

16 |

16 |

14 |

14 |

13 |

12 |

12 |

11 |

| 26 |

Michigan |

|

|

|

|

|

|

|

|

|

3 |

5 |

5 |

6 |

6 |

8 |

8 |

11 |

11 |

13 |

14 |

14 |

14 |

14 |

15 |

19 |

19 |

20 |

20 |

21 |

21 |

20 |

18 |

17 |

16 |

| 32 |

Minnesota |

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

4 |

4 |

5 |

5 |

7 |

9 |

9 |

11 |

11 |

12 |

11 |

11 |

11 |

11 |

10 |

10 |

10 |

10 |

10 |

10 |

| 20 |

Mississippi |

|

|

|

|

|

|

3 |

3 |

4 |

4 |

6 |

6 |

7 |

7 |

0 |

0 |

8 |

8 |

9 |

9 |

9 |

10 |

10 |

10 |

9 |

9 |

8 |

8 |

7 |

7 |

7 |

7 |

6 |

6 |

| 24 |

Missouri |

|

|

|

|

|

|

3 |

3 |

4 |

4 |

7 |

7 |

9 |

9 |

11 |

11 |

15 |

15 |

16 |

17 |

17 |

18 |

18 |

18 |

15 |

15 |

13 |

13 |

12 |

12 |

11 |

11 |

11 |

10 |

| 41 |

Montana |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

3 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

3 |

3 |

3 |

| 37 |

Nebraska |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

5 |

8 |

8 |

8 |

8 |

8 |

7 |

6 |

6 |

6 |

5 |

5 |

5 |

5 |

5 |

5 |

| 36 |

Nevada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

4 |

4 |

5 |

6 |

| 9 |

New Hampshire |

5 |

6 |

6 |

7 |

8 |

8 |

8 |

8 |

7 |

7 |

6 |

6 |

5 |

5 |

5 |

5 |

5 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

| 3 |

New Jersey |

6 |

7 |

7 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

7 |

7 |

7 |

7 |

7 |

7 |

9 |

9 |

9 |

10 |

10 |

12 |

12 |

14 |

16 |

16 |

16 |

16 |

17 |

17 |

16 |

15 |

15 |

14 |

| 47 |

New Mexico |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

4 |

4 |

4 |

4 |

4 |

5 |

5 |

5 |

5 |

| 11 |

New York |

8 |

12 |

12 |

19 |

29 |

29 |

29 |

36 |

42 |

42 |

36 |

36 |

35 |

35 |

33 |

33 |

35 |

35 |

36 |

36 |

36 |

39 |

39 |

45 |

47 |

47 |

45 |

45 |

43 |

41 |

36 |

33 |

31 |

29 |

| 12 |

North Carolina |

|

12 |

12 |

14 |

15 |

15 |

15 |

15 |

15 |

15 |

11 |

11 |

10 |

10 |

0 |

9 |

10 |

10 |

11 |

11 |

11 |

12 |

12 |

12 |

13 |

14 |

14 |

14 |

13 |

13 |

13 |

14 |

15 |

15 |

| 39 |

North Dakota |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

4 |

3 |

3 |

3 |

3 |

3 |

| 17 |

Ohio |

|

|

|

3 |

8 |

8 |

8 |

16 |

21 |

21 |

23 |

23 |

23 |

23 |

21 |

21 |

22 |

22 |

23 |

23 |

23 |

23 |

23 |

24 |

26 |

25 |

25 |

25 |

26 |

25 |

23 |

21 |

20 |

18 |

| 46 |

Oklahoma |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

10 |

11 |

10 |

8 |

8 |

8 |

8 |

8 |

8 |

7 |

7 |

| 33 |

Oregon |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

3 |

3 |

3 |

4 |

4 |

4 |

4 |

5 |

5 |

6 |

6 |

6 |

6 |

6 |

7 |

7 |

7 |

7 |

| 2 |

Pennsylvania |

10 |

15 |

15 |

20 |

25 |

25 |

25 |

28 |

30 |

30 |

26 |

26 |

27 |

27 |

26 |

26 |

29 |

29 |

30 |

32 |

32 |

34 |

34 |

38 |

36 |

35 |

32 |

32 |

29 |

27 |

25 |

23 |

21 |

20 |

| 13 |

Rhode Island |

|

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

| 8 |

South Carolina |

7 |

8 |

8 |

10 |

11 |

11 |

11 |

11 |

11 |

11 |

9 |

9 |

8 |

8 |

0 |

6 |

7 |

7 |

9 |

9 |

9 |

9 |

9 |

9 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

8 |

9 |

| 40 |

South Dakota |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

4 |

4 |

4 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

3 |

3 |

3 |

3 |

| 16 |

Tennessee |

|

|

3 |

5 |

8 |

8 |

8 |

11 |

15 |

15 |

13 |

13 |

12 |

12 |

0 |

10 |

12 |

12 |

12 |

12 |

12 |

12 |

12 |

12 |

11 |

12 |

11 |

11 |

11 |

10 |

11 |

11 |

11 |

11 |

| 28 |

Texas |

|

|

|

|

|

|

|

|

|

|

|

4 |

4 |

4 |

0 |

0 |

8 |

8 |

13 |

15 |

15 |

18 |

18 |

20 |

23 |

23 |

24 |

24 |

25 |

26 |

29 |

32 |

34 |

38 |

| 45 |

Utah |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

5 |

5 |

5 |

6 |

| 14 |

Vermont |

|

4 |

4 |

6 |

8 |

8 |

8 |

7 |

7 |

7 |

6 |

6 |

5 |

5 |

5 |

5 |

5 |

5 |

4 |

4 |

4 |

4 |

4 |

4 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

| 10 |

Virginia |

12 |

21 |

21 |

24 |

25 |

25 |

25 |

24 |

23 |

23 |

17 |

17 |

15 |

15 |

0 |

0 |

11 |

11 |

12 |

12 |

12 |

12 |

12 |

12 |

11 |

11 |

12 |

12 |

12 |

12 |

12 |

13 |

13 |

13 |

| 42 |

Washington |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

4 |

5 |

5 |

7 |

8 |

8 |

9 |

9 |

9 |

9 |

10 |

11 |

11 |

12 |

| 35 |

West Virginia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

5 |

5 |

5 |

6 |

6 |

6 |

7 |

7 |

8 |

8 |

8 |

8 |

8 |

7 |

6 |

6 |

5 |

5 |

5 |

| 30 |

Wisconsin |

|

|

|

|

|

|

|

|

|

|

|

4 |

5 |

5 |

8 |

8 |

10 |

10 |

11 |

12 |

12 |

13 |

13 |

13 |

12 |

12 |

12 |

12 |

12 |

11 |

11 |

11 |

10 |

10 |

| 44 |

Wyoming |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

| # |

Total |

81 |

135 |

138 |

176 |

218 |

221 |

235 |

261 |

288 |

294 |

275 |

290 |

296 |

303 |

234 |

294 |

366 |

369 |

401 |

444 |

447 |

476 |

483 |

531 |

537 |

538 |

Source: Presidential Elections 1789–2000 at Psephos (Adam Carr’s Election Archive)

Note: In 1788, 1792, 1796, and 1800, each elector cast two votes for president.

Number of electors from each state for the 2012, 2016 and 2020 presidential elections in which 12 electoral votes changed between 18 states, based on the 2010 census, eight states lost one electoral vote and two (New York and Ohio) each lost two electoral votes while eight states gained electoral votes, six gained one electoral vote, Florida gained two and Texas gained four

Alternative methods of choosing electors

Methods of presidential elector selection, by state, 1789–1832[84]

| Year |

|

AL |

CT |

DE |

GA |

IL |

|

IN |

KY |

LA |

ME |

MD |

|

MA |

MS |

MO |

NH |

NJ |

|

NY |

NC |

OH |

PA |

RI |

|

SC |

TN |

VT |

VA |

| 1789 |

|

– |

L |

D |

L |

– |

|

– |

– |

– |

– |

A |

|

H |

– |

– |

H |

L |

|

– |

– |

– |

A |

– |

|

L |

– |

– |

D |

| 1792 |

|

– |

L |

L |

L |

– |

|

– |

D |

– |

– |

A |

|

H |

– |

– |

H |

L |

|

L |

L |

– |

A |

L |

|

L |

– |

L |

D |

| 1796 |

|

– |

L |

L |

A |

– |

|

– |

D |

– |

– |

D |

|

H |

– |

– |

H |

L |

|

L |

D |

– |

A |

L |

|

L |

H |

L |

D |

| 1800 |

|

– |

L |

L |

L |

– |

|

– |

D |

– |

– |

D |

|

L |

– |

– |

L |

L |

|

L |

D |

– |

L |

A |

|

L |

H |

L |

A |

| 1804 |

|

– |

L |

L |

L |

– |

|

– |

D |

– |

– |

D |

|

D |

– |

– |

A |

A |

|

L |

D |

A |

A |

A |

|

L |

D |

L |

A |

| 1808 |

|

– |

L |

L |

L |

– |

|

– |

D |

– |

– |

D |

|

L |

– |

– |

A |

A |

|

L |

D |

A |

A |

A |

|

L |

D |

L |

A |

| 1812 |

|

– |

L |

L |

L |

– |

|

– |

D |

L |

– |

D |

|

D |

– |

– |

A |

L |

|

L |

L |

A |

A |

A |

|

L |

D |

L |

A |

| 1816 |

|

– |

L |

L |

L |

– |

|

L |

D |

L |

– |

D |

|

L |

– |

– |

A |

A |

|

L |

A |

A |

A |

A |

|

L |

D |

L |

A |

| 1820 |

|

L |

A |

L |

L |

D |

|

L |

D |

L |

D |

D |

|

D |

A |

L |

A |

A |

|

L |

A |

A |

A |

A |

|

L |

D |

L |

A |

| 1824 |

|

A |

A |

L |

L |

D |

|

A |

D |

L |

D |

D |

|

A |

A |

D |

A |

A |

|

L |

A |

A |

A |

A |

|

L |

D |

L |

A |

| 1828 |

|

A |

A |

L |

A |

A |

|

A |

A |

A |

D |

D |

|

A |

A |

A |

A |

A |

|

D |

A |

A |

A |

A |

|

L |

D |

A |

A |

| 1832 |

|

A |

A |

A |

A |

A |

|

A |

A |

A |

A |

D |

|

A |

A |

A |

A |

A |

|

A |

A |

A |

A |

A |

|

L |

A |

A |

A |

| Year |

|

AL |

CT |

DE |

GA |

IL |

|

IN |

KY |

LA |

ME |

MD |

|

MA |

MS |

MO |

NH |

NJ |

|

NY |

NC |

OH |

PA |

RI |

|

SC |

TN |

VT |

VA |

| Key |

A |

Popular vote, At-large |

D |

Popular vote, Districting |

L |

Legislative selection |

H |

Hybrid system |

Before the advent of the short ballot in the early 20th century, as described above, the most common means of electing the presidential electors was through the general ticket. The general ticket is quite similar to the current system and is often confused with it. In the general ticket, voters cast ballots for individuals running for presidential elector (while in the short ballot, voters cast ballots for an entire slate of electors). In the general ticket, the state canvass would report the number of votes cast for each candidate for elector, a complicated process in states like New York with multiple positions to fill. Both the general ticket and the short ballot are often considered at-large or winner-takes-all voting. The short ballot was adopted by the various states at different times; it was adopted for use by North Carolina and Ohio in 1932. Alabama was still using the general ticket as late as 1960 and was one of the last states to switch to the short ballot.

The question of the extent to which state constitutions may constrain the legislature’s choice of a method of choosing electors has been touched on in two U.S. Supreme Court cases. In McPherson v. Blacker, 146 U.S. 1 (1892), the Court cited Article II, Section 1, Clause 2 which states that a state’s electors are selected “in such manner as the legislature thereof may direct” and wrote these words “operat[e] as a limitation upon the state in respect of any attempt to circumscribe the legislative power”. In Bush v. Palm Beach County Canvassing Board, 531 U.S. 70 (2000), a Florida Supreme Court decision was vacated (not reversed) based on McPherson. On the other hand, three dissenting justices in Bush v. Gore, 531 U.S. 98 (2000), wrote: “[N]othing in Article II of the Federal Constitution frees the state legislature from the constraints in the State Constitution that created it.”[85]

Appointment by state legislature

In the earliest presidential elections, state legislative choice was the most common method of choosing electors. A majority of the state legislatures selected presidential electors in both 1792 (9 of 15) and 1800 (10 of 16), and half of them did so in 1812.[86] Even in the 1824 election, a quarter of state legislatures (6 of 24) chose electors. In that election, Andrew Jackson lost in spite of having pluralities of both the popular and electoral votes,[87] with the outcome being decided by the six state legislatures choosing the electors. Some state legislatures simply chose electors, while other states used a hybrid method in which state legislatures chose from a group of electors elected by popular vote.[88] By 1828, with the rise of Jacksonian democracy, only Delaware and South Carolina used legislative choice.[87] Delaware ended its practice the following election (1832), while South Carolina continued using the method until it seceded from the Union in December 1860.[87] South Carolina used the popular vote for the first time in the 1868 election.[89]

Excluding South Carolina, legislative appointment was used in only four situations after 1832:

- In 1848, Massachusetts statute awarded the state’s electoral votes to the winner of the at-large popular vote, but only if that candidate won an absolute majority. When the vote produced no winner between the Democratic, Free Soil, and Whig parties, the state legislature selected the electors, giving all 12 electoral votes to the Whigs.[90]

- In 1864, Nevada, having joined the Union only a few days prior to Election Day, had no choice but to legislatively appoint.[90]

- In 1868, the newly reconstructed state of Florida legislatively appointed its electors, having been readmitted too late to hold elections.[90]

- Finally, in 1876, the legislature of the newly admitted state of Colorado used legislative choice due to a lack of time and money to hold a popular election.[90]

Legislative appointment was brandished as a possibility in the 2000 election. Had the recount continued, the Florida legislature was prepared to appoint the Republican slate of electors to avoid missing the federal safe-harbor deadline for choosing electors.[91]

The Constitution gives each state legislature the power to decide how its state’s electors are chosen[87] and it can be easier and cheaper for a state legislature to simply appoint a slate of electors than to create a legislative framework for holding elections to determine the electors. As noted above, the two situations in which legislative choice has been used since the Civil War have both been because there was not enough time or money to prepare for an election. However, appointment by state legislature can have negative consequences: bicameral legislatures can deadlock more easily than the electorate. This is precisely what happened to New York in 1789 when the legislature failed to appoint any electors.[92]

Electoral districts

Another method used early in U.S. history was to divide the state into electoral districts. By this method, voters in each district would cast their ballots for the electors they supported and the winner in each district would become the elector. This was similar to how states are currently separated by congressional districts. However, the difference stems from the fact every state always had two more electoral districts than congressional districts. As with congressional districts, moreover, this method is vulnerable to gerrymandering.

Proportional vote

Under such a system, electors would be selected in proportion to the votes cast for their candidate or party, rather than being selected by the statewide plurality vote.[93]

Congressional district method

There are two versions of the congressional district method: one has been implemented in Maine and Nebraska; another has been proposed in Virginia. Under the implemented congressional district method, the electoral votes are distributed based on the popular vote winner within each of the states’ congressional districts; the statewide popular vote winner receives two additional electoral votes.[94]

In 2013, a different version of the congressional district method was proposed in Virginia. This version would distribute Virginia’s electoral votes based on the popular vote winner within each of Virginia’s congressional districts; the two statewide electoral votes would be awarded based on which candidate won the most congressional districts, rather than on who won Virginia’s statewide popular vote.[95]

The congressional district method can more easily be implemented than other alternatives to the winner-takes-all method, in view of major party resistance to relatively enabling third parties under the proportional method. State legislation is sufficient to use this method.[96]Advocates of the congressional district method believe the system would encourage higher voter turnout and incentivize presidential candidates to broaden their campaigns in non-competitive states.[97] Winner-take-all systems ignore thousands of popular votes; in Democratic California there are Republican districts, in Republican Texas there are Democratic districts. Because candidates have an incentive to campaign in competitive districts, with a district plan, candidates have an incentive to actively campaign in over thirty states versus seven “swing” states.[98][99] Opponents of the system, however, argue candidates might only spend time in certain battleground districts instead of the entire state and cases of gerrymandering could become exacerbated as political parties attempt to draw as many safe districts as they can.[100]

Unlike simple congressional district comparisons, the district plan popular vote bonus in the 2008 election would have given Obama 56% of the Electoral College versus the 68% he did win; it “would have more closely approximated the percentage of the popular vote won [53%]”.[101]

Implementation

Of the 43 multi-district states whose 514 electoral votes could be affected by the congressional district method, only Maine (4 EV) and Nebraska (5 EV) currently utilize this allocation method.[102] Maine began using the congressional district method in the election of 1972. Nebraska has used the congressional district method since the election of 1992.[103][104] Michigan used the system for the 1892 presidential election,[94][105][106] and several other states used various forms of the district plan before 1840: Virginia, Delaware, Maryland, Kentucky, North Carolina, Massachusetts, Illinois, Maine, Missouri, and New York.[107]