Pronk Pops Show 93, November 30, 2012: Segment 2: U.S. Debt By Presidents–Obama: $5.073 Trillion in Four Years, Bush: $3.294 Trillion in Eight Years–Videos

Pronk Pops Show 93: November 30, 2012

Pronk Pops Show 92: November 10, 2012

Pronk Pops Show 91: November 5, 2012

Pronk Pops Show 90: October 29, 2012

Pronk Pops Show 89: October 22, 2012

Pronk Pops Show 88: October 7, 2012

Pronk Pops Show 87: September 7, 2012

Listen To Pronk Pops Podcast or Download Shows 92

Listen To Pronk Pops Podcast or Download Shows 91

Listen To Pronk Pops Podcast or Download Shows 88-90

Listen To Pronk Pops Podcast or Download Shows 84-87

Listen To Pronk Pops Podcast or Download Shows 79-83

Listen To Pronk Pops Podcast or Download Shows 74-78

Listen To Pronk Pops Podcast or Download Shows 71-73

Listen To Pronk Pops Podcast or Download Shows 68-70

Listen To Pronk Pops Podcast or Download Shows 65-67

Listen To Pronk Pops Podcast or Download Shows 62-64

Listen To Pronk Pops Podcast or Download Shows 58-61

Listen To Pronk Pops Podcast or Download Shows 55-57

Listen To Pronk Pops Podcast or Download Shows 52-54

Listen To Pronk Pops Podcast or Download Shows 49-51

Listen To Pronk Pops Podcast or Download Shows 45-48

Listen To Pronk Pops Podcast or Download Shows 41-44

Listen To Pronk Pops Podcast or Download Shows 38-40

Listen To Pronk Pops Podcast or Download Shows 34-37

Listen To Pronk Pops Podcast or Download Shows 30-33

Listen To Pronk Pops Podcast or Download Shows 27-29

Listen To Pronk Pops Podcast or Download Shows 17-26

Listen To Pronk Pops Podcast or Download Shows 16-22

Listen To Pronk Pops Podcast or Download Shows 10-15

Listen To Pronk Pops Podcast or Download Shows 01-09

Segment 2: U.S. Debt By Presidents–Obama: $5.073 Trillion in Four Years, Bush: $3.294 Trillion in Eight Years–Videos

U.S. Debt Clock

http://www.usdebtclock.org/

US Federal Debt since the Founding

The United States federal government began with a substantial debt, the cost of the Revolutionary War. Under Alexander Hamilton’s funding system the debt was paid off by 1840. Government debt has typically peaked after wars. It breached 30 percent of GDP after the Revolutionary War, the Civil War, and World War I. It breached 100 percent of GDP in World War II. Government debt also breached 100 percent of GDP in the aftermath of the financial crisis of 2008.

Gross Federal Debt vs. Net Debt

The US federal government differentiates between Gross Debt issued by the US Treasury and Net Debt held by the public. The numbers on Gross Debt are published by the US Treasury here.

Numbers on various categories of federal debt, including Gross Debt, debt held by federal government accounts, debt held by the public, and debt held by the Federal Reserve System, are published every year by the Office of Management and Budget in the Federal Budget in the Historical Tables as Table 7.1 — Federal Debt at the End of the Year. The table starts in 1940. You can find the latest Table 7.1 in here.

The chart above shows three categories of federal debt.

1. Monetized debt (blue), i.e., federal debt bought by the Federal Reserve System

2. Debt held by the federal government (red) e.g., as IOUs for Social Security

3. Other debt (green), i.e., debt in public hands, including foreign governments.

The bar chart comes directly from the Monthly Treasury Statement published by the U. S. Treasury Department. <<< Click on the chart for more info.The “Debt Total” bar chart is generated from the Treasury Department’s “Debt Report” found on the Treasury Direct web site. It has links to search the debt for any given date range, and access to debt interestinformation. It is a direct source to government provided budget information.

|

|

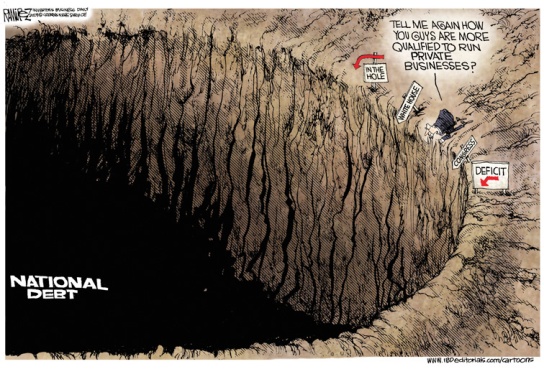

— “Deficit” vs. “Debt”—Suppose you spend more money this month than your income. This situation is called a “budget deficit”. So you borrow (ie; use your credit card). The amount you borrowed (and now owe) is called your debt. You have to pay interest on your debt. If next month you spend more than your income, another deficit, you must borrow some more, and you’ll still have to pay the interest on your debt (now larger). If you have a deficit every month, you keep borrowing and your debt grows. Soon the interest payment on your loan is bigger than any other item in your budget. Eventually, all you can do is pay the interest payment, and you don’t have any money left over for anything else. This situation is known as bankruptcy.

Each year since 1969, Congress has spent more money than its income. The Treasury Department has to borrow money to meet Congress’s appropriations. Here is a direct link to the Congressional Budget Office web site’s deficit analysis. We have to pay interest* on that huge, growing debt; and it cuts into our budget big time. |

http://www.federalbudget.com/ FINANCIAL MANAGEMENT SERVICE STAR - TREASURY FINANCIAL DATABASE TABLE 1. SUMMARY OF RECEIPTS, OUTLAYS AND THE DEFICIT/SURPLUS BY MONTH OF THE U.S. GOVERNMENT (IN MILLIONS) ACCOUNTING DATE: 10/12 PERIOD RECEIPTS OUTLAYS DEFICIT/SURPLUS (-) + ____________________________________________________________ _____________________ _____________________ _____________________ PRIOR YEAR OCTOBER 163,072 261,539 98,466 NOVEMBER 152,402 289,704 137,302 DECEMBER 239,963 325,930 85,967 JANUARY 234,319 261,726 27,407 FEBRUARY 103,413 335,090 231,677 MARCH 171,215 369,372 198,157 APRIL 318,807 259,690 -59,117 MAY 180,713 305,348 124,636 JUNE 260,177 319,919 59,741 JULY 184,585 254,190 69,604 AUGUST 178,860 369,393 190,533 SEPTEMBER 261,566 186,386 -75,180 YEAR-TO-DATE 2,449,093 3,538,286 1,089,193 CURRENT YEAR OCTOBER 184,316 304,311 119,995 YEAR-TO-DATE 184,316 304,311 119,995

http://www.fms.treas.gov/mts/mts1012.txt

Projected and Recent US Federal Debt Numbers

| Gross Federal Debt |

Debt Held by Public |

Debt Held by Federal Reserve |

|

| FY 2013* | $17.5 trillion | $10.6 trillion | $2.1 trillion |

| FY 2012* | $16.4 trillion | $9.7 trillion | $1.9 trillion |

| FY 2011 | $14.8 trillion | $8.5 trillion | $1.7 trillion |

| FY 2010 | $13.5 trillion | $8.2 trillion | $0.8 trillion |

| FY 2009 | $11.9 trillion | $6.8 trillion | $0.8 trillion |

| FY 2008 | $10.0 trillion | $5.3 trillion | $0.5 trillion |

“Gross Federal Debt” is the total debt owed by the United States federal government. It comprises “Debt Held by Public”, including foreign governments, debt held by federal government accounts such as IOUs owed to the Social Security trust fund, and “Debt held by Federal Reserve,” debt bought by the Federal Reserve System as part of the monetary base.

http://www.usgovernmentspending.com/federal_debt_chart.html

Another Day Older & Deeper In Debt: Federal Deficit to Top $1 Trillion for Fiscal Year 2012

Peter Schiff U.S. Debt Crisis

Vicious cycle of the US Debt & Deficit

President Obama Blaming Bush for Debt

Deficits, Debts and Unfunded Liabilities: The Consequences of Excessive Government Spending

Public Opinion for Libertarians – Bryan Caplan

Social Security trustees: We’re going broke

John C. Goodma

“…Here’s some bad news: The latest report of the Social Security and Medicare trustees shows an unfunded liability for both programs of $63 trillion. That is equal to about 4.5 times the entire U.S. gross domestic product.

The unfunded liability is the amount we have promised in benefits, looking indefinitely into the future, minus the payroll taxes and premiums we expect to collect. It’s the amount we must have in the bank today, earning interest, for these entitlement programs to be solvent.

We not only don’t have the money in the bank, no one has a serious plan to put it there.

Now — some really bad news. The actual liability is almost twice what the government is reporting. In 2009, the trustees calculated the two programs’ unfunded liability at about 6.5 times the size of the U.S. economy. But the next year the unfunded liability was cut in half. The reason: “Obamacare.” The minute President Barack Obama signed his health reform bill, he cut Medicare’s unfunded liability by more than $50 trillion.

You would think this accomplishment would be an occasion for great joy — for dancing and celebration in the streets. If you’re like most Americans, however, you probably haven’t heard about it. Certainly, the Obama administration isn’t talking.

Here is what’s going on: Obamacare uses cuts in Medicare to pay for more than half the cost of expanding health insurance for young people. So even if the Medicare cuts take place, they won’t reduce the government’s overall obligations. They just replace entitlements for seniors with entitlements for young people. In addition, the health reform bill contains no serious plan for making Medicare more efficient.

So the only realistic way to make cuts in Medicare spending is a mechanism that will pay less and less to doctors and hospitals over time.

The Center for Medicare & Medicaid Service’s Office of the Actuaries has predicted what this can mean for seniors. By the end of this decade, the fees that Medicare pays to doctors will be lower than what Medicaid pays. From an economic view, seniors will represent a less profitable sector than welfare mothers represent. Also by the end of the decade, one in seven hospitals will be forced out of business. In the decades that follow, the consequences only seem to get worse.

Many serious people inside the Beltway believe these cuts will never take place, however. The reason: Congress has been unwilling to allow similar reductions in doctor fees for nine straight years under previous legislation.

In fact, the possibility of “Obamacare” policies cutting Medicare’s unfunded liability in half is so unlikely that Medicare’s chief actuary, Richard Foster, provides an “alternative” report, in addition to the official trustees report, in which he projects much higher levels of Medicare spending.

What about the Medicare trust fund? Workers have been repeatedly told that their payroll taxes are being securely held in trust funds. But they are actually spent the very minute they arrive in the Treasury’s bank account. No money has been saved. No investments have been made. No cash has been stashed in bank vaults. Today’s payroll tax payments are being spent to pay medical bills for today’s retirees. And if any surplus materializes, it is spent on other government programs. As a result, when today’s workers reach the eligibility age of 65, they will be able to receive benefits only if future taxpayers pay (even higher) taxes to support them.

To address these defects, Medicare must be truly reformed. That means shifting from the current “pay as you go” system to one in which workers pay their own way.

My colleagues and I have calculated that workers (and their employers) must save and invest 4 percent of payroll. Eventually, we will reach the point where each generation of retirees will pay for the bulk of its own post-retirement medical care — with a payroll tax no higher than the one we have today.

We also need other reforms, of course. Seniors should be free to manage more of their own health care dollars. Doctors should be free to repackage their services in ways that lower the cost to patients and raise the quality of care. Seniors should also have access to more services, whose price is set in the marketplace rather than dictated by governments.

Most importantly, we need bipartisan commitment from those on Capitol Hill who can make all of this happen.

John C. Goodman is president of the National Center for Policy Analysis, research fellow at the Independent Institute and author of the book “Priceless: Curing the Healthcare Crisis,” due out in June. …”

Read more: http://www.politico.com/news/stories/0412/75603.html#ixzz2DRkCo9CU

US could be on path to fifth straight $1 trillion deficit after government runs $120 billion October deficit

“…The federal government started the 2013 budget year with a $120 billion deficit, an indication that the nation is on a path to its fifth straight $1 trillion-plus deficit.

Another soaring deficit puts added pressure on President Barack Obama and Congress to seek a budget deal in the coming weeks.

The Treasury Department said Tuesday that the October deficit — the gap between the government’s tax revenue and its spending — was 22 percent higher than the same month last year.

Tax revenue increased to $184.3 billion — 13 percent greater than the same month last year. Still, spending also rose to $304.3 billion, a 16.4 percent jump. The budget year begins on Oct. 1. Officials said last year’s figures were held down by a quirk in the calendar: the first day of October fell on a Saturday, which resulted in some benefits being paid in September 2011.

The deficit, in simplest terms, is the amount of money the government has to borrow when revenues fall short of expenses. The government ran a $1.1 trillion annual budget deficit in fiscal year that ended in September. That was lower than the previous year but still painfully high by historical standards.

Obama’s presidency has coincided with four straight $1 trillion-plus deficits — the first in history and record he had to vigorously defend during his successful re-election campaign.

The size and scope of this year’s deficit will largely depend on what happens with the so-called fiscal cliff — a package of tax increases and spending cuts set to take effect in January unless the White House and Congress reach a budget deal by then.

If the economy goes over the fiscal cliff, this year’s deficit would shrink to $641 billion, according to the Congressional Budget Office. But the CBO also warns that the economy would sink into recession in the first half of 2013.

If the White House and Congress can reach a budget deal that extends the tax cuts and avoids the spending cuts, the deficit will end up roughly $1 trillion for the budget year, the CBO says.

The deficits have been growing for more than a decade but reached a record $1.41 trillion in 2009, Obama’s first year in office. That was largely because of the worst recession since the Great Depression. Tax revenue plummeted during the downturn, while the government spent more on stimulus programs.

The deficits first began to widen after President George W. Bush won approval for broad tax cuts and launched wars in Afghanistan and Iraq.

One of the biggest challenges for the federal budget is the aging of the baby boom generation. That is raising government spending on Social Security and on Medicare and Medicaid. At the same time, the fragile economy, along with tax cuts, has reduced government revenue.

Over the past three years, revenue has fallen below 16 percent of the total economy as measured by the gross domestic product. Spending has exceeded 22 percent of GDP. The government has been forced to borrow to make up the gap, which has pushed the federal debt to $16.2 trillion.

The government is expected to hit its borrowing limit of $16.39 trillion by the end of December, unless Congress votes to raise it again. …”

http://www.foxnews.com/politics/2012/11/13/us-government-runs-120-billion-october-deficit/

The Facts About Budget Deficits: How The Presidents Truly Rank

James K. Glassman, Contributor

“…Please forgive me. Over and over, I hear misinformation about deficits in prior administrations, and I can’t keep quiet any longer. I have to correct the record.

The latest was on “Squawk Box” on Monday morning. Joe Kernan, the host, is interviewing former Vermont Gov. Howard Dean, ex-candidate for president and chairman of the Democratic National Committee. Kernen cites campaign comments about “bad policies” going back “decades” affecting the high rate of unemployment today.

He asks, “What specific policies in the Bush Administration do you think are still being used to explain 8 percent unemployment?”

Dean responds, “The biggest ones are the deficits that were run up…. The deficits were enormous

Let’s shed some factual light on the situation by turning to table B-79 of the current Economic Report of the President. There we find the official statistics on federal spending, receipts, and deficits (or surpluses) as proportions of Gross Domestic Product. These are the figures that economists use in determining the relationship of the deficit to the overall economy, answering the question, “How much more are we spending than taking in?”

We can average the deficit-to-GDP ratio during a presidential term and get a good take on whether “deficits were enormous” in historic terms or not. The only tricky part is whether to give a president credit (or blame) for his incoming and outgoing years. For example, President Reagan took office on Jan. 20, 1980, but fiscal year 1980 started four months earlier. Similarly, he left office Jan. 20, 1989, but fiscal 1989 still had four months to run.

I decided to use three sets of calculations for each president: first, the deficit-to-GDP ratio from the fiscal year he took office to the fiscal year he left minus one (thus, for Reagan: 1981-88); second, from his first fiscal year plus one to the fiscal year he left (thus, 1982-89); and third, an average of the first two

Here are the ratios of deficit to GDP for the past five presidents:

Ronald Reagan 1981-88 4.2 % 1982-89 4.2 Average 4.2

George H. W. Bush 1989-92 4.0 1990-93 4.3 Average 4.2

Bill Clinton 1993-2000 0.8 1994-2001 0.1 Average 0.5

George W. Bush 2001-08 2.0 2002-09 3.4 Average 2.7

Barack Obama 2009-12* 9.1 2010-12 8.7 Average 8.9 *fiscal 2012 ends Sept. 30, 2012, so this figure is estimated

Source: Economic Report of the President, February 2012

The results for President Bush are skewed by the 10.1 percent deficit/GDP ratio in fiscal 2009. A large chunk of spending in that year went to the Troubled Asset Relief Program, or TARP. In fiscal 2009, TARP contributed $151 billion to the budget deficit, but in 2010 and 2011, $147 billion of that amount was recouped and thus reduced the size of the deficit during President Obama’s watch. (These calculations are complicated and are laid out by the Office of Management and Budget. See http://www.whitehouse.gov/sites/default/files/omb/budget/fy2013/assets/spec.pdf, p. 49.)

As for spending itself, during the George W. Bush years (2001-08), federal outlays averaged 19.6 percent of GDP, a little less than during the Clinton years (1993-2000), at 19.8% and far below Reagan, whose outlays never dropped below 21 percent of GDP in any year and averaged 22.4%. Even factoring in the TARP year (2009), Bush’s average outlays as a proportion of the economy was 20.3 percent – far below Reagan and only a half-point below Clinton. As for Obama, even excluding 2009, his spending has averaged 24.1 percent of GDP – the highest level for any three years since World War II.

Americans can judge for themselves whether deficits are “enormous”– but only if they have the facts. In this case, there is no denying the order in which the last five presidents rank on the basis of deficits: Clinton, Bush 43, Bush 41 and Reagan in a virtual tie, and Obama. …”

U.S. Debt by President

By Kimberly Amadeo, About.com Guide

The Best Way to Measure Debt by President:

“…Therefore, the most accurate way to measure the debt by President is to sum all the budget deficits. That’s because the President is responsible for his budget priorities. It takes into account spending, and anticipated revenue from proposed tax cuts or hikes.

There are a few caveats, however. First, Congress does have a role, since it must approve the budget. Second, each President inherits a previous President’s policies. For example, every President has had to compensate for lower revenue thanks to President Reagan’s tax cuts. That’s because tax increases are a sure way to prevent re-election.

Third, while every President has had to deal with a recession, all recessions were not created equal. Furthermore, some Presidents have had to deal with unusual events, like the 9/11 terrorist attack and Hurricane Katrina. While these weren’t part of the business cycle, they required responses that came with economic price tags.

President Barack Obama:

President George W. Bush:

President Ronald Reagan:

President George H.W. Bush:

Budget Deficits by Fiscal Year Since 1960:

President Barack Obama: First Term = $5.073 trillion.

- FY 2013 – $901 billion.

- FY 2012 – $1.327 trillion.

- FY 2011 – $1.299 trillion.

- FY 2010 – $1.546 ($1.293 trillion plus $253 billion from the Obama Stimulus Act that was attached to the FY 2009 budget).

President George W. Bush: First Term = $1.267 trillion. Second Term = $2.027 trillion. Total = $3.294.

- FY 2009 – $1.16 trillion. ($1.416 trillion minus $253 billion from Obama’s Stimulus Act)

- FY 2008 – $458 billion.

- FY 2007 – $161 billion.

- FY 2006 – $248 billion.

- FY 2005 – $318 billion.

- FY 2004 – $413 billion.

- FY 2003 – $378 billion.

- FY 2002 – $158 billion.

President Bill Clinton: First Term = $496 billion. Second Term = ($559 billion surplus). Total = ($63 billion surplus).

- FY 2001 – $128 billion surplus.

- FY 2000 – $236 billion surplus.

- FY 1999 – $126 billion surplus.

- FY 1998 – $69 billion surplus.

- FY 1997 – $22 billion.

- FY 1996 – $107 billion.

- FY 1995 – $164 billion.

- FY 1994 – $203 billion.

President George H.W. Bush: First Term = $1.03 trillion.

- FY 1993 – $255 billion.

- FY 1992 – $290 billion.

- FY 1991 – $269 billion.

- FY 1990 – $221 billion.

President Ronald Reagan: First Term = $733 billion. Second Term = $679 billion. Total = $1.412 trillion.

- FY 1989 – $153 billion.

- FY 1988 – $155 billion.

- FY 1987 – $150 billion.

- FY 1986 – $221 billion.

- FY 1985 – $212 billion.

- FY 1984 – $185 billion.

- FY 1983 – $208 billion.

- FY 1982 – $128 billion.

President Jimmy Carter: First Term = $253 billion

- FY 1981 – $79 billion.

- FY 1980 – $74 billion.

- FY 1979 – $41 billion.

- FY 1978 – $59 billion.

President Gerald Ford: Three Years = $181 billion.

- FY 1977 – $54 billion.

- FY 1976 – $74 billion.

- FY 1975 – $53 billion.

President Richard Nixon: First Term = $64 billion. First Year of Second Term = $6 billion. Total = $70 billion.

- FY 1974 – $6 billion.

- FY 1973 – $15 billion.

- FY 1972 – $23 billion.

- FY 1971 – $23 billion.

- FY 1970 – $3 billion.

President Lyndon B. Johnson: Two Years in First Term = $7 billion. Second Term = $35 billion. Total = $42 billion.

- FY 1969 – $3 billion surplus.

- FY 1968 – $25 billion.

- FY 1967 – $9 billion.

- FY 1966 – $4 billion.

- FY 1965 – $1 billion.

- FY 1964 – $6 billion.

President John F. Kennedy: Two Years in First Term = $11 billion.

- FY 1963 – $5 billion.

- FY 1962 – $7 billion.

President Dwight Eisenhower: First Term = $3 billion surplus. Second Term = $19 billion. Total = $16 billion.

- FY 1961 – $3 billion.

- FY 1960 – $0 billion (slight surplus).

- FY 1959 – $13 billion.

- FY 1958 – $3 billion.

- FY 1957 – $3 billion surplus.

- FY 1956 – $4 billion surplus.

- FY 1955 – $3 billion.

- FY 1954 – $1 billion.

President Harry Truman: First Term = $1 billion surplus. Second Term = $4 billion. Total = $3 billion.

- FY 1953 – $6 billion.

- FY 1952 – $1 billion.

- FY 1951 – $6 billion surplus.

- FY 1950 – $3 billion.

- FY 1949 – $1 billion surplus.

- FY 1948 – $12 billion surplus.

- FY 1947 – $4 billion surplus.

- FY 1946 – $16 billion.

President Franklin D. Roosevelt: First Term = $13 billion. Second Term = $11 billion. Third Term = $172 billion. Total = $196 billion.

- FY 1945 – $48 billion.

- FY 1944 – $48 billion.

- FY 1943 – $55 billion.

- FY 1942 – $21 billion.

- FY 1941 – $5 billion.

- FY 1940 – $3 billion.

- FY 1939 – $3 billion.

- FY 1938 – $0 billion (slight deficit).

- FY 1937 – $2 billion.

- FY 1936 – $4 billion.

- FY 1935 – $3 billion.

- FY 1934 – $4 billion.

President Herbert Hoover: First Term = $5 billion.

- FY 1933 – $3 billion.

- FY 1932 – $3 billion.

- FY 1931 – $0 billion (slight deficit).

- FY 1930 – $1 billion surplus.

President Calvin Coolidge: Two Years of First Term = $2 billion surplus. Second Term = $4 billion surplus. Total = $6 billion surplus.

- FY 1929 – $1 billion surplus.

- FY 1928 – $1 billion surplus.

- FY 1927 – $1 billion surplus.

- FY 1926 – $1 billion surplus.

- FY 1925 – $1 billion surplus.

- FY 1924 – $1 billion surplus.

President Warren G. Harding: Two Years of First Term = $2 billion surplus.

- FY 1923 – $1 billion surplus.

- FY 1922 – $1 billion surplus.

President Woodrow Wilson: First Term = $1 billion. Second Term = $21 billion. Total = $22 billion.

- FY 1921 – $1 billion surplus.

- FY 1920 – $0 billion (slight surplus).

- FY 1919 – $13 billion.

- FY 1918 – $9 billion.

- FY 1917 – $1 billion.

- FY 1916 – $0 billion (slight surplus).

- FY 1915 – $0 billion (slight surplus).

- FY 1914 – $0 billion.

FY 1789 – FY 1913 – $24 billion surplus. (Source: OMB, Table 1.1—Summary of Receipts, Outlays, and Surpluses or Deficits: 1789–2017) …”

Leave a comment